All you need to know, and our recommendations, about your teleworking/working abroad declarations.

From now on, the employers must include in their monthly declarations the expected average percentage of work and/or teleworking performed abroad. Indeed, while salary declarations are monthly (taxation, social charges, and days of teleworking or outside Luxembourg), the thresholds for "switching" social security regimes and/or tax allocation per country are annual, meaning they depend on the location(s) of the activity and the number of days spent in each country to carry out the salaried activity by the employee.

Many circumstances such as specific missions at clients' sites, illness, or personal changes of employees can have a significant impact on their exact social and tax situation. A form A1 is in practice mandatory for all employees performing teleworking and/or activities in multiple countries of the European Union, Switzerland, and the European Economic Area countries.

Given that specific cases are the norm in Luxembourg, we recommend in practice to verify at least each quarter whether the actual situation of employees corresponds to the declared situation in order to prepare the necessary regularization as early as possible. The cost and time of managing these regularizations can be significant.

It is necessary (in our view and such is our recommendation) for the employer to define a clear teleworking and foreign travel policy while verifying in practice the exact situation in which their employees find themselves as from the beginning of the calendar year (and/or for each period considered in other particular cases) to ensure that the corresponding declarations closely match the actual activity of the employee in the various countries where they work as from the beginning of the calendar year.

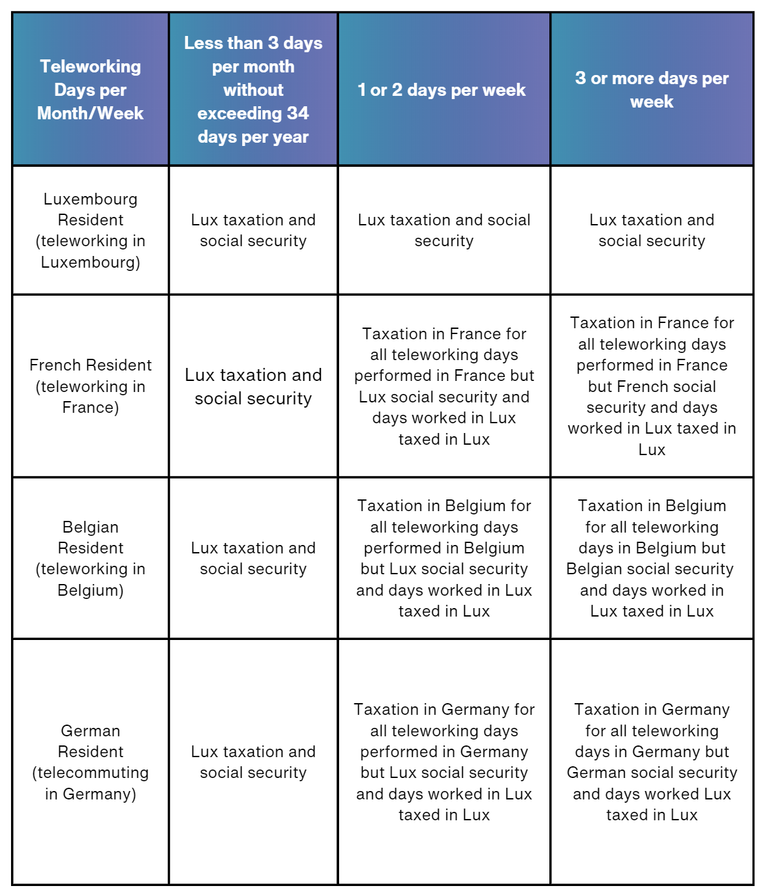

We have prepared a simplified summary below of our recommendations. Naturally, each specific case must be checked individually.

It should be noted that we only address the case of the employees employed in Luxembourg working abroad where applicable (but not employees employed outside Luxembourg and carrying out activities in Luxembourg where applicable). Similarly, we do not address self-employed individuals, permanent seconded employees, or board members/managers whose work abroad may raise establishment issues and for whom particular attention is required.

Regarding Luxembourg tax residents, teleworking does not raise any particular issues since they are employed by Luxembourg companies and thus, this teleworking in Luxembourg does not entail any change in social security regime or taxation of the employees. There is in principle a superposition of the workplace and of their residence, except in cases of secondment.

For Luxembourg tax residents, only secondment abroad, i.e., activity carried out abroad, requires compliance with secondment formalities and could, if applicable, lead to taxation of their activity outside Luxembourg, as well as the possibility or necessity to affiliate with the social security of another country.

Regarding German tax residents, teleworking or activity in Germany for more than 19 days in 2023 and more than 34 days in 2024, entails the switching/transfer of the taxation of these days worked in Germany to being subject to German income tax. Naturally, any secondment outside Luxembourg of these employees generally involves adding these days to the quota of days worked in Germany. Exact analysis is required because exact rules depend in practice on the existence of potentially applicable tax treaties.

The switch of the social security regime is set at 25% for usual activities carried out in Germany, 50% for the exercise of teleworking from their country of residence (Germany).

Regarding Belgian tax residents, telecommuting or activity in Belgium for more than 34 days in 2023 and 2024, entails the switching/transfer of the taxation of these days worked in Belgium to being subject to Belgian income tax. Naturally, any secondment outside Luxembourg of these employees generally involves adding these days to the quota of days worked in Belgium. Exact analysis is required because exact rules depend in practice on the existence of potentially applicable tax treaties.

The switch of the social security regime is set at 25% for usual activities carried out in Belgium, 50% for the exercise of teleworking from their country of residence (Belgium).

Regarding French tax residents, teleworking or activity in France for more than 34 days in 2023 and 2024, entails the switching of the taxation of these days worked in France to being subject to French income tax. Naturally, any secondment outside Luxembourg of these employees generally involves adding these days to the quota of days worked in France. Exact analysis is required because exact rules depend in practice on the existence of potentially applicable tax treaties. The switch of the social security regime is set at 25% for usual activities carried out in France, 50% for the exercise of telecommuting from their country of residence (France).